Trade Inflection Trading from the trenches Weekly update Weekend 13th March

Well what a week again. It’s been a difficult week to navigate all the news bombs. Finally on Friday we had the weekly breakout high to 4336 (news bomb) and then when the market opened we had the slam. Friday was a particularly difficult day to trade. Still what ever the bulls say this market is getting spanked on any rip higher. So the big question is does the market now go back to ATH’s or at least back into 200/50 MA or continue a more bearish trajectory. The one big thing to note here is the absolutely orderly market to the downside which is why it is so frustrating. There appears to be no panic, no one way traffic, So on certain days we have just this slow drip down, personally I hate that type of market. I blame the options guys as I think certainly with OPEX this week and FED there are multiple forces at play here.

Last weekend I mentioned the below.

“Certainly over the next few weeks it will be a close call, personally I would like another lower low but as a trader I don’t give a hoot as long as I have volatility - that’s all I care about.”

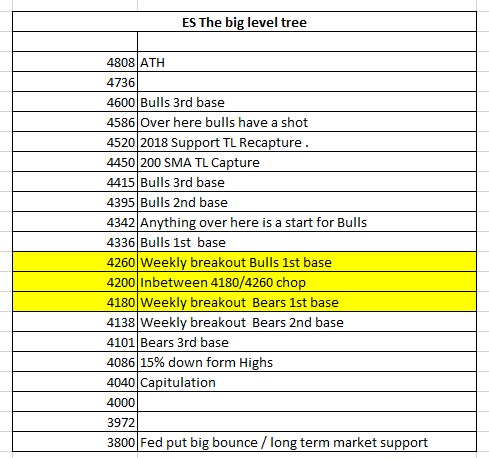

After Friday it certainly starts to look that this is on the agenda I have been surprised we have not traded that 4101 yet on the low side. So for this week I will look at my ES Big level tree for my guidance. Bulls have no chance till 4260 is cleared, above this they have a chance. Bears still really don’t get going till 4138 (last weeks low) has been tackled and then 4100. So where did we close, pretty much bang in the middle at 4200 which isn’t really helpful. So for this week I will play those levels as my key reference. Obviously there is head line risk with Russia/ Ukraine conflict. I am not going to predict anything other that it will continue ! War continues not bullish, war stops bullish!

The next hurdles for the week will be Wednesday Fed meeting then OPEX Friday.

For FED 25bps is priced in for sure, I expect Powell to be the soothing voice he usually is, i.e. we will wait on developments with the war and see where we go kind of thing. Clearly with sanctions, and if war continues inflation is screwed, well if we are going to be honest it is screwed NOW. So the longer he waits the more inflation begets inflation. He better hope for a quick resolution to the war asap as food prices metals, commodities, crude etc are all hitting the roof. My expectation is they will try and sit it out and just fucking hope. Note if they increase by 50 bps then I expect this to be very negative, I expect this will not happen.

So is this environment I think it is hard to see a real bullish move post the FED but you never know. Positioning is skewed so it could happen. As for OPEX its anyone’s guess other than the 2 biggest strikes are 4100 and 4200 so we need to be mindful of that. So in essence as I always say one can not predict the future so we will let price dictate and play level to level using the big level tree and charts below as our guide.

Lets have a look at the big picture - These are the levels I will use to determine market trajectory. Each level captured indicates to me where the big players are willing to take the market - which ever direction. I then trade level to level with runners.

ES Monthly - The support trendline from the Dec18 lows gave way in February Bulls need to recapture this, currently the trendline is around 4520 - Until this is captured and retested as support - it is sell the rips.

Weekly

You can see a very nice channel here. This is where the 4336 got hit on the upper trendline. The bottom of this channel comes in at 3930 .. with 4030/4040 on the way.

ES 6 hour - I have been showing this for the last couple of weeks. You can see it broke down from the original triangle and has now created another one. This is the TL from the ATH 4808 so it’s very important, particularly if we break up

So in summary breakout over 4260 bullish/4330 ish super bullish below 4180/4139 we are in danger of new lows. Trade accordingly. Good luck. TI

Last week we made 159 ES points which is 463 in the past 3 weeks and 516 in the past 4 weeks. All in real time.

https://www.tradeinflection.com/result

@TradeInflection

Free Discord trial:

https://discord.gg/SncsGJj5