Trade Inflection Trading from the trenches Pre Open 1st of March

Morning All

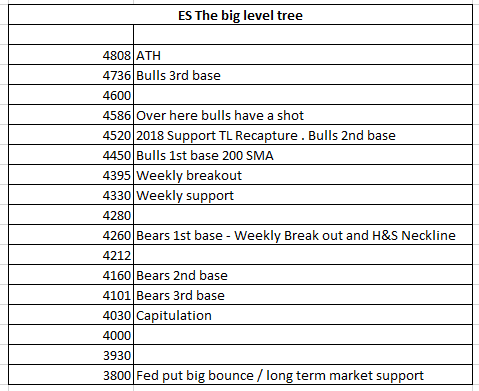

A new month begins and what delights will it bring for us, more volatility I hope. Yesterday played out almost text book big gap down overnight to 4260, remember I mentioned in my big level tree as this was Bears 1st base. As noted again below I said this was weekly breakout for Bears and what did our friends the Bears do? Well they do what they usually do, they dropped the ball! Over the RTH session Bulls filled the gap and then it was text book consolidation if not outright chop, back and forth between 4385 and 4311 finishing with a strong rally for the close. As I sit here now at 9.30 am UK time / 04.30 EST we are trading 4354, overnight high was 4398 another fake out of the weekly breakout level of 4395.

So where does this leave us? Well it means the same as yesterday we are in a range that at some point will breakout. For today we have ISM Manufacturing that I would expect will not move the needle much note we have non farm at the end of the week.

So for today I will use the 6 hour chart I posted at the weekend as my guide, the trend line from the highs 4808 comes in at 4364 and the lower trend line comes in at 4326 so these will be my breakout points for the day.

This will keep me safe, I will then drill down to the 5m or 15m when necessary. Levels for today are as follows. Let price dictate. I Will also keep an eye on NQ my Bull Bear line is 14100. Long above short below

4364, 75 95 400 412 450 below we have 26/30 310 300 280 260 between 364 and 326 is chop. Note essentially this is all chop within the 395/260 range. Below is the 6 hour ES chart.

Yesterday was not a bad day in the room - we did the following trades

Short 40 went to 28 we got breakeven - arse!

Short 35 stopped 40 -5

Long 39 out 56 +17

Long 14 out 32 +18

Short 26 stop 29 -3

Short 62 stopped 66 -4

Long TSLA Call 900 paid 13 and still in.

So in the end we were up +21 ES and +25 NQ which for a Monday was not too bad.

I will give updates during the day if I see important technical / market info. Note we are still in major News Bomb situation so keep your trades low size and wide stops but always remember the big picture. Cheers TI