Well what a week. The volatility has been back this year and I for one am loving it. Volatility brings plenty of opportunities each day. As I have stated many times low and wide keeps you safe in this environment. Markets have remained very technical and in keeping with their nature have the odd insane rip! Like we have seen on Thursday and Friday. So the big question is does the market now go back to ATH’s or continue a more bearish trajectory. Twitter as always gives you plenty of views …. 4700 4800 5000 ? or 3800 don’t worry which ever way it goes they will delete their opposing tweet. Get it into your head no one knows! As far as I know it is impossible to predict the future … But Twitter furus have always predicted heads and tails and then told you their brilliance when the coin lands on either side. Certainly over the next few weeks it will be a close call, personally I would like another lower low but as a trader I don’t give a hoot as long as I have volatility - that’s all I care about.

Background - Where are we - The 3 bogeyman

When British Prime Minister Harold Macmillan was asked what was the greatest challenge for a statesman, he replied: 'Events, dear boy, events'. This is where we are. Russian / Ukraine and the spill over to the West, in particular Europe is clearly a major event. Whilst the West rolled over the markets loved it, but this is always a game of cat and mouse …. If at any time Russia uses its strongest card and turns the gas or oil taps off to Europe then to put it politely, Europe is screwed! Germany in particular (Europe imports 30% of it’s oil and Germany imports 40% of its gas from Russia) it also happens to be Europe’s strongest economy. Depending on how long Russia turns of the taps it could pretty much land us with a recession. This event would not surprise me even if just a quick shot across the bows as Russia will need to remind the world how it can hurt if provoked.

Bogeyman #2

Everyone over the past week has forgotten about Inflation… The market can never think about two things at one. Inflation PCE, CPI where ever you look, Europe, USA the world over inflation is flying high. This will continue. Clearly the events of the above could also keep inflation high particularly in the Oil / Commodities space.

Bogeyman #3

Fed, BOE. ECB tapering and increasing rates - This hasn’t changed and will start in the USA in earnest over the next few weeks at the next Fed meeting. Can the market actually stand on it’s own two feet. It is my view it never has, it certainly hasn’t in the past 12 years. Constant injection of money via bond purchases has completely distorted the equity markets and this is all going to stop.

So to summarize Political events, Inflationary/ Stagflation pressures, Central Bank tightening, recessionary risk and increasing rates is not a bullish market.

So to the week ahead

The only way to play to these markets on daily basis is level to level especially as we are day traders. We want our daily bread, that’s all and we can then be thankful.

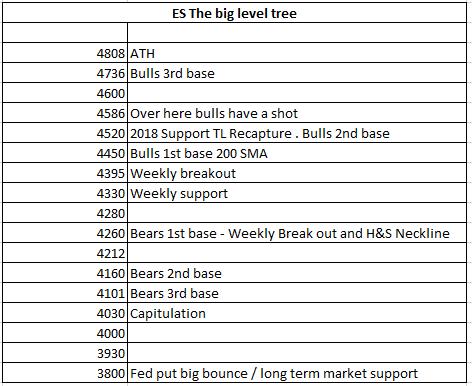

Lets have a look at the big picture - These are the levels I will use to determine market trajectory. Each level captured indicates to me where the big players are willing to take the market - which ever direction. I then trade level to level with runners.

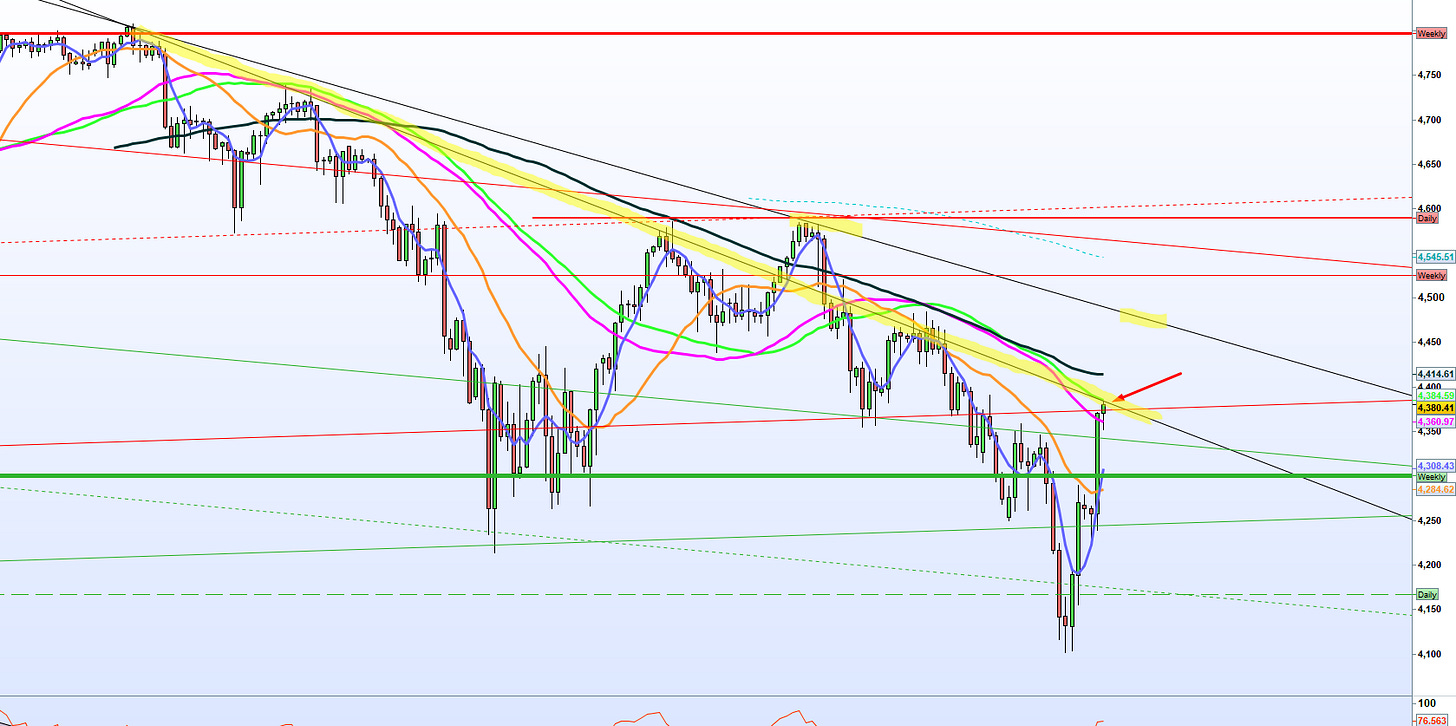

ES Monthly - The support trendline from the Dec18 lows gave way in February Bulls need to recapture this, currently the trendline is around 4520 - Until this is captured and retested as support - it is sell the rips.

ES 6 hour - Look at where we closed on Friday right at the ATH down trending trendline. Bravo Bulls but they will need to break out over 4395 - this will be key this week. I have drawn 2 trendlines the upper one is around 4480 and moving down I would suspect it would possibly retouch at around 4450 i.e. the 200 DMA. This would be formidable resistance and I would see a short term fade possibly back to 4395.

So in summary breakout over 4395 bullish below 4330/4280 /4260 we are in danger of new lows. Trade accordingly. Good luck. TI

https://www.tradeinflection.com/result

@TradeInflection

Very informative Dom,nice job!